Hurdle Rate Vc

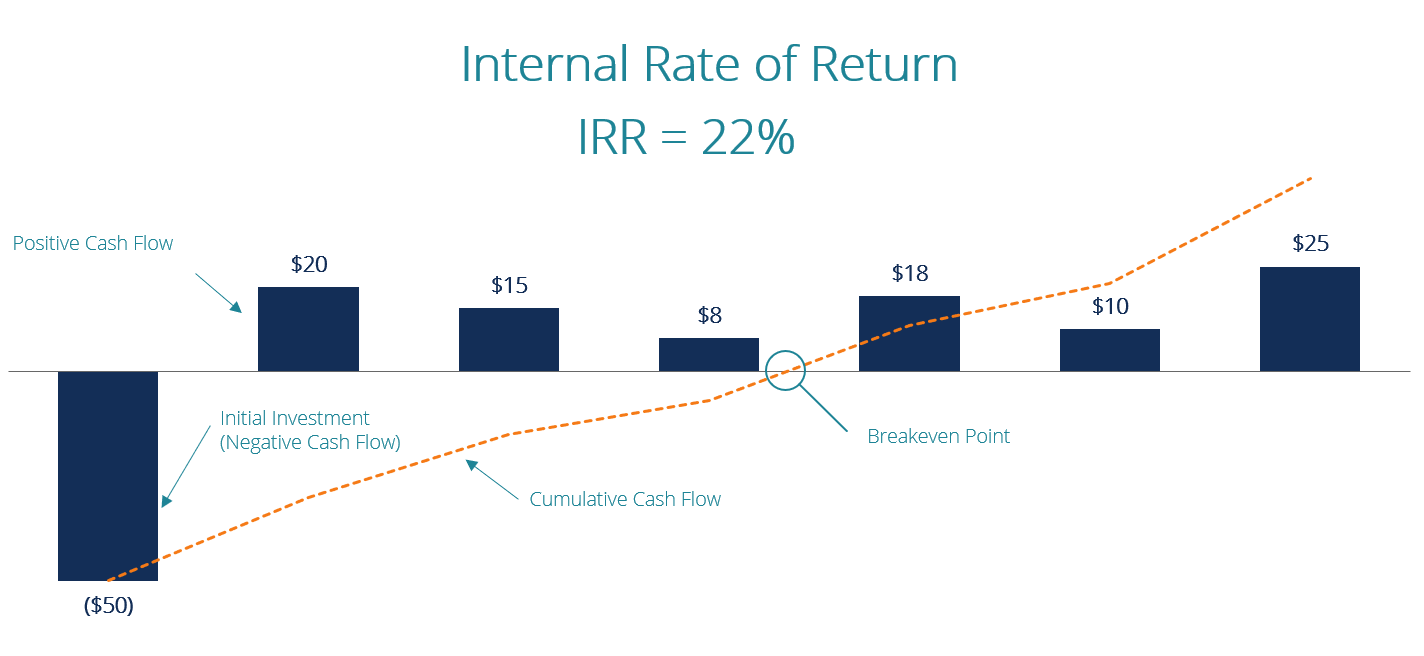

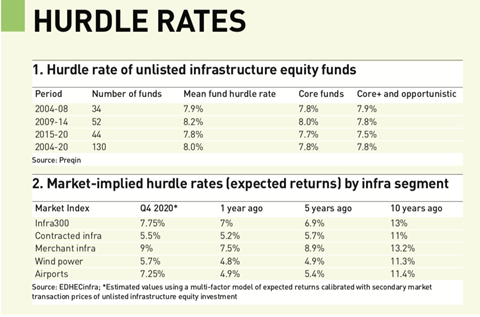

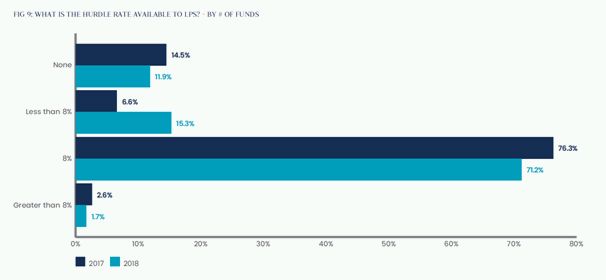

A hurdle rate which is also known as minimum acceptable rate of return MARR is the minimum required rate of return or target rate that investors are expecting to receive on an investment. Only 38 percent of VC funds tracked over two decades produced gains exceeding the traditional 8 percent hurdle according to a.

Why Vc S Seek 10x Returns Nexit Ventures

5 Reasons Why You Should Take A Working Capital Loan Banking Venture Capital Instant Cash Loans

Moats Neumann Disruptive Innovation Taxonomy Data Charts

7 Steps To Build Your Startup Business Video Start Up Business Startup Funding Start Up

Hurdle Rate Remains Elusive For Vc Funds Novo Resourcing Ltd

Lp Corner Fund Terms Carried Interest Preferred Return And Gp Catchup Allen Latta S Thoughts On Private Equity Etc

Hurdle Rate Remains Elusive For Vc Funds Novo Resourcing Ltd

Core Context Diagram Context Diagram Mission

Hurdle Rate Remains Elusive For Vc Funds Novo Resourcing Ltd

Interview With Donald A Steinbrugge Cfa Managing Partner Agecroft Partners Interview Hedges Portfolio

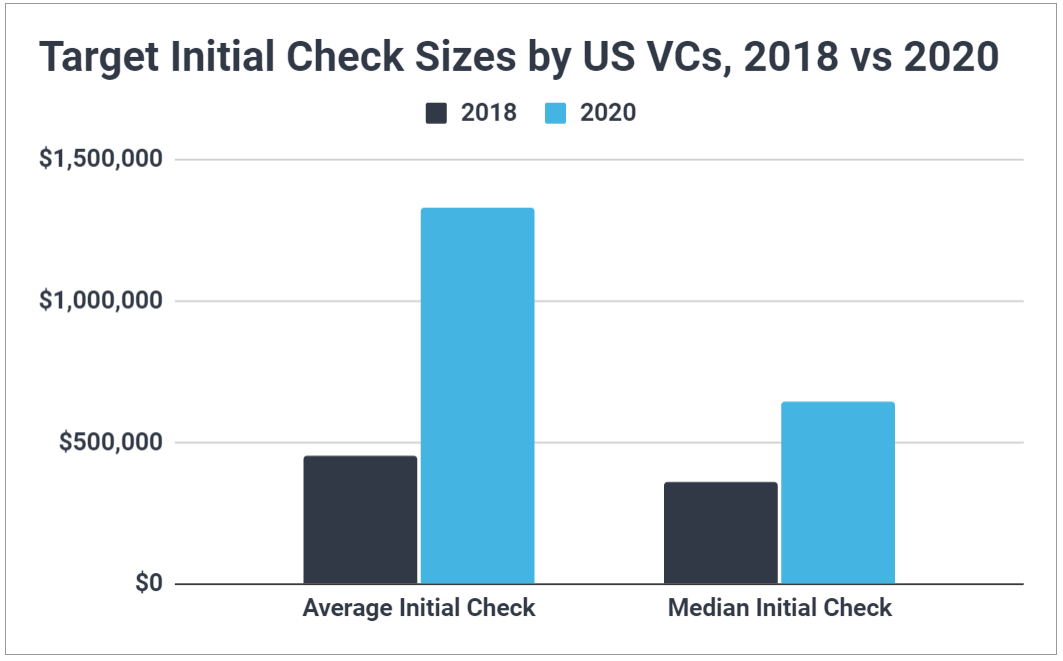

Vc Firms Being Disadvantaged By Traditional 8 Hurdle Rate Compared To Pe Altassets Private Equity News

Internal Rate Of Return Irr A Guide For Financial Analysts

7 Steps To Build Your Startup Business Video Start Up Business Startup Funding Start Up

4 Important Reason Why Startups Fail How To Stay Motivated Make A Person Start Up

Hurdle Rates A Ticking Timebomb Magazine Real Assets

Corporate Venture Capital Compensation Snapshot The Venture Alley

Chart Of The Week 8 Pct Remains Most Common Hurdle Rate Buyouts

Private Equity Fund Terms Research Core Economic Terms Hurdle Rate And Carried Interest Corporate Commercial Law Uk